Corporate

governance

GRI 2-9, 2-11

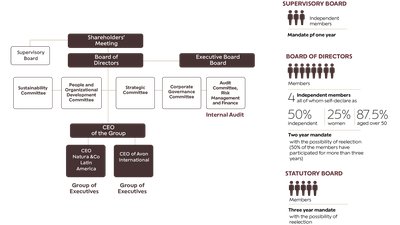

Natura &Co’s corporate governance plays a fundamental role as a strategic foundation for the ethical, transparent and responsible guidance of the business, ensuring the alignment between the interests of the different stakeholders and the longevity of the organization. In 2024, the management bodies remained focused on establishing strategic directives for its business units and the growth and transformation of the Company.

Despite the Annual and Extraordinary General Meeting (AGO/E), the Company's main deliberative and decision-making forum, having elected nine members to the Board of Directors, there are currently only eight members due to the resignation of two elected members. The Board of Directors has decided upon a replacement member for one of the positions, reappointing the CEO of Natura &Co, Fábio Colletti Barbosa, as one of the board members. The Board of Directors is composed of three co-chairpersons, elected from amongst the board members, one of whom is also elected to the position of Chairperson for Board meetings. These positions are currently occupied by the founders of Natura Cosmetics, who are members of the Company's controlling group and signatories to the shareholders' agreement. The other members of the Board are independent, exceeding the percentage required by the regulations established by the B3’s ‘Novo Mercado’, except for Fábio Coletti Barbosa, due to his position as an executive at the Company.

Our Bylaws expressly establish that the positions of Co-chairperson of the Board of Directors and CEO cannot be assumed by the same person, thereby ensuring a clear separation between strategic supervision and executive functions. This structure reflects Natura’s commitment to independent and transparent governance, in order to ensure impartiality in strategic decisions.

This structure reflects Natura’s commitment to independent and transparent governance, in order to ensure impartiality in strategic decisions.

The Natura &Co Board includes two non-executive/independent members who hold four or fewer external mandates in publicly held companies: Gilberto Mifano and Carla Schmitzberger. There is no restriction on the total number of board memberships that members can hold, since the Company does not limit the participation of the board members in other companies.

The Board Members are elected for single, two year mandates. Under this process, the General Meeting is provided with a single list of candidates and the members are elected by means of a majority vote, or a cumulative vote, if requested.

The Company's governance structure continues to be formed by a Board of Directors and a Statutory Board which, together, are responsible for management. In 2024, the Products and Brands Committee was added to the Advisory Committees, for a total of six organs offering their specialist support to the Board of Directors. At the AGO/E, the shareholders once again requested the establishment of the Fiscal Council, a power guaranteed by Brazilian legislation. The organ is currently composed of three members (two nominated by the controlling shareholders and one by the minority shareholders) and their respective substitutes. The Company can also rely upon the support of the executives and CEOs of its two business units as well as the CEO of Natura &Co.

Amongst the most important legal and statutory responsibilities of the Board of Directors, and other issues which it also handles, of special note in 2024 were the alterations made to its composition following the O/EGM, the revision and approval of the strategic planning of Natura and Avon in Latin America, the financial support for Avon Products Inc. in its voluntary financial restructuring process in the United States, and the substitution of the firm responsible for the Company's independent audit. In addition to this, the Board of Directors approved the voluntary cancellation, through the SEC, of the registration on the New York Stock Exchange (NYSE) due to the fact that the majority of the transactions of the Company's shares are conducted on the B3 in Brazil.

These activities reflect the Board’s main responsibilities, as outlined in article 20 of the Company’s Bylaws. The Board is also responsible for analyzing the effectiveness and execution of the business plan, supervising the executive team, taking strategic decisions, such as those involving investments and divestments, guaranteeing integrity and ethics in the company’s operations, and defining the objectives and guidelines for sustainable development. The Company also has a Risk Management Policy and the Natura &Co Global Code of Conduct, which are both periodically revised and approved by the Board of Directors.

GRI 2-13

The Company and its business units take into account environmental, social and economic criteria, as well as the impacts they generate, when taking decisions. These criteria are also included when evaluating Arrow Right risks, impacts and opportunities connected to sustainable development that affect all the stakeholders - employees, partners, customers, suppliers, shareholders, investors, creditors and the communities with which we have relations.

GRI 2-12, 2-13

We follow the market’s best governance practices, as recommended by the Brazilian Code of Corporate Governance (CBGC). In 2024, we were 96% in compliance with the principles of the CBGC, which is published by the Brazilian Institute of Corporate Governance (IBGC).

The Commitment to Life and the long-term vision of the business units are the object of regular analysis and monitoring by the Board of Directors, with support provided by the Sustainability Committee and assurance through the internal processes, as is the creation of this Integrated Report, which is subject to the co-Presidents’ evaluation of its accuracy and alignment with the Company’s purpose, culture and strategic projects.

GRI 2-12, 2-14, 2-17

We follow the market’s best governance practices, as recommended by the Brazilian Code of Corporate Governance (CBGC).

In relation to this area, the Board of Directors is also responsible for supervising the inclusion of the organization’s policy commitments. To achieve this, it delegates responsibilities by defining and continually monitoring clear targets and commitments, encouraging collaboration and team work, recognizing performance, and conducting periodic reviews of the process.

GRI 2-24

We have adopted a set of measures designed to improve the Board of Directors’ understanding of issues related to sustainable development, including: constant access to updated information, exchange of experiences between the members, constant engagement of the leaders to promote sustainable practices; and continual education and training, thus providing frequent updates on global trends and best practices.

GRI 2-17

In line with this approach, since October 2024, the Sustainability Committee has included the participation of an external consultant who is specialized in the analysis of social environmental management processes; expert understandings form a part of its decisions. The Committee is principally responsible for monitoring the results and suggesting adjustments, whenever necessary, to the strategies pursued by the Company and its business units, regarding issues associated with sustainability and the achievement of the objectives established in the Commitment to Life, which the Company undertook in 2020. Over the course of the year, the Committee held four meetings with the results and recommendations being reported to the Board of Directors, thereby ensuring effective supervision and the ongoing improvement of the processes related to sustainable development.

GRI 2-12

The Board of Directors also has the support of executive departments, especially the Sustainability Board, to which it delegates functions in its efforts to control impacts related to social environmental matters. The responsibilities delegated include the development and implementation of sustainability strategies, the evaluation and monitoring of sustainability performance, the guaranteeing of compliance with regulations and norms, the integration of sustainability in the operations and processes, and engagement of the stakeholders.

GRI 2-13

our 2024 Governance Report here.

Highest governance bodies

GRI 2-9, 2-10

The composition of the boards, committees and Executive Board on December 31, 2024, as described here, is available on the Company's Investor Relations website.

Advisory Committees (Consultative)

- Audit, Risk and Financial Management (eight ordinary meetings and four extraordinary meetings; three members, all independent; two sub-committees holding 12 meetings)

- Personnel and Organizational Development (six ordinary meetings and no extraordinary meetings; three members, two of whom are independent)

- Strategic (four ordinary meetings and one extraordinary meeting; three members, two of whom are independent)

- Corporate Governance (five ordinary meetings and no extraordinary meetings; three members, none of whom are independent)

- Sustainability (four ordinary meetings and no extraordinary meetings; five members, one of whom is independent)

- Products and Brands (two ordinary meetings and no extraordinary meetings; four members, one of whom is independent)

Nomination and selection to the Board of Directors

GRI 2-10

The process for nomination and selection of members of the Board of Directors and its committees is guided by the Bylaws and by the Administrator Nomination Policy. The process is supervised by the Corporate Governance Committee, which is responsible for ensuring that the nominations are in line with the organizational guidelines.

The selection criteria include the involvement of stakeholders and analysis of the candidates’ relevant skills and experience, ensuring that the members indicated are suitable to supervise the company’s economic, social and environmental impacts.

In exceptional cases, such as when a new member was elected in July 2024, the process can be relaxed. This indication occurred after two of the members had resigned, following the General Assembly held on April 26, 2024. Given the need for an immediate replacement, the Board prioritized the recommendation to nominate the CEO of Natura &Co, who had previous experience on the Board and could immediately assume the role.

The relaxing of the criteria, although not usual, was conducted transparently and within the scope of the internal regulations, ensuring the effective continuity of governance, whilst preserving the integrity and stability of the strategic operations.

Remuneration of the Board of Directors

GRI 2-19, 2-20, 2-21

The annual remuneration of the Board of Directors consists of one fixed quota, including additional, pre-established sums depending upon participation or leadership of advisory committees, and one variable quota, based upon actions, aligning the Board of Directors’ business strategy with the Company's long-term success and the value creation for the interested parties.

The stakeholders and members of the Board of Directors are consulted on remuneration-related policies, to ensure that they meet the expectations and needs of all those involved. Furthermore, the General Shareholders’ Meeting supervises the process for definition of the administrators’ remunerations.

The remuneration also takes into account our commitment to equality, and we make full use of studies developed in partnership with a consulting firm specializing in human resources.

Natura performs periodic evaluations of the Board of Directors and its advisory committees, in accordance with the terms of the Regulations of the Novo Mercado (New Market). The process includes an annual self-evaluation of these bodies, the Corporate Governance Officer, and the Corporate Governance system.

The methodology involves individual interviews with the Board Members, consolidation of the conclusion and suggestions obtained, analysis of this information by the Corporate Governance Committee, and, finally, a presentation to the Board of Directors. Based upon these analyses, the Board can continue with the positive points or implement improvements in line with the suggestions made. The evaluation does not include individual analyses of the Board Members or the committees.

about our performance evaluation practices, the selection criteria, the qualifications required and the profiles of our executives and board members on our Investor Relations website.